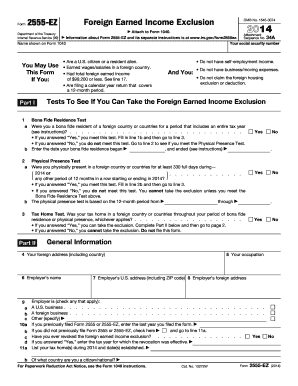

A tax credit usually means more money in your pocket. Form 2555 - Foreign Earned Income 2014 free download and preview download free printable template samples in PDF Word and Excel formats.

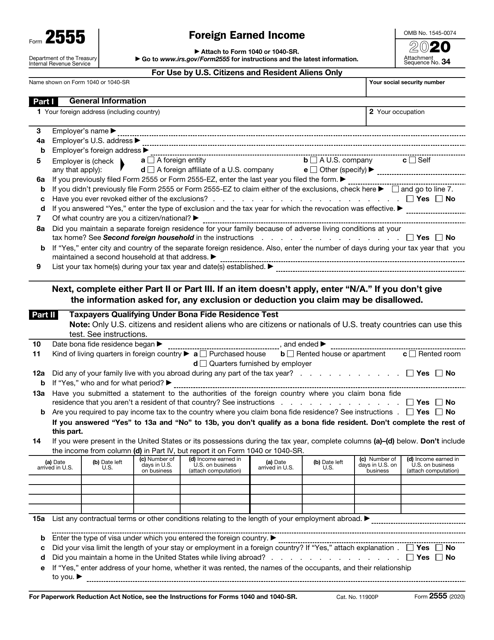

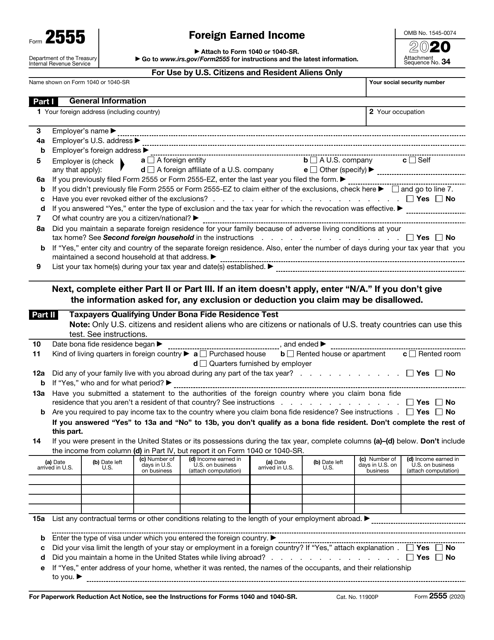

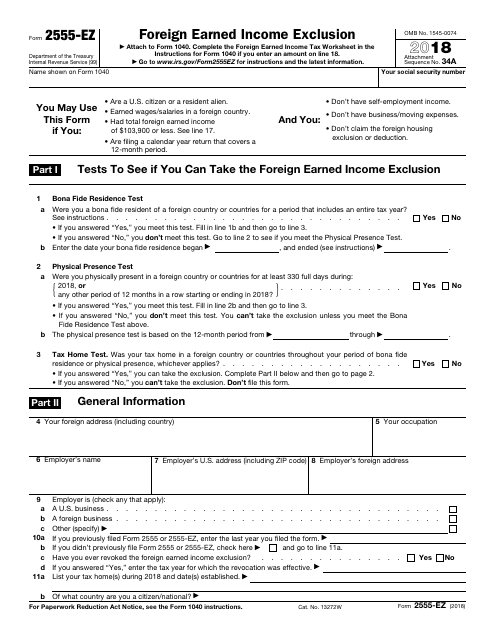

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Use the Tax Table Tax Computation Worksheet Qualified Dividends and Capital Gain Tax Worksheet Schedule D Tax Worksheet or Form 8615 whichever applies.

Foreign earned income tax worksheet 2014. Double click the copy you wish to print. Have records to prove that the tax has been paid. Worksheet in their tax form instructions.

Start your TaxAct Desktop program. What the worksheet does is that it determines the tax rate as if income was not excluded and then applies that tax rate to the actual taxable income as reported on the tax return. The Form 2555 Foreign Earned Income Allocation Worksheet is designed to report the allocation between US.

Do not use a second Foreign Earned Income Tax Worksheet to figure the tax on this line 4. If you were sent here from your Schedule 8812 in structions. Have paid the tax on the income overseas.

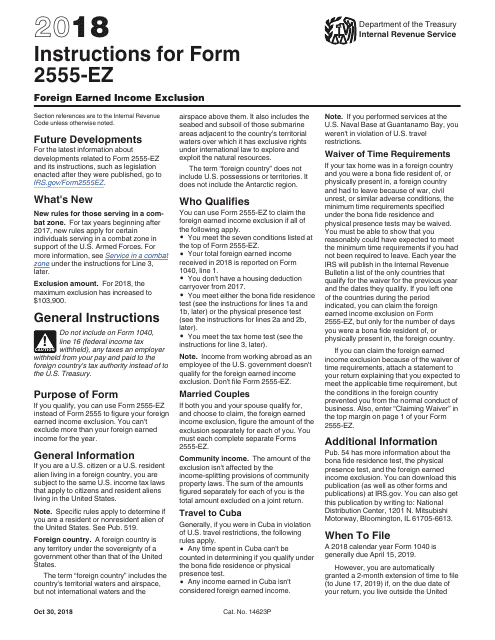

If Form 1040 or 1040-SR line 11b is zero dont complete this worksheet. For tax year 2020 the maximum foreign earned income exclusion amount is the lesser of the foreign income earned or 107600 per qualifying person. If you were sent here from your Form 1040 Form 1040A or Form 1040NR instructions.

The offset amount you are entitled to will not always be the same amount of the tax paid overseas. The Internal Revenue Code IRC explains that you must figure tax on the non-FEI using the rates that would have applied if the exclusion wasnt taken. Enter the amount from your and your spouses if filing jointly Form 2555 lines 45 and 50.

The tax home is in a foreign country and the taxpayer qualifies for the exclusions and deduction under either the bona fide residence test or the physical presence test to claim an exclusion or a deduction from gross income for the housing. To be eligible for a foreign income tax offset you must. If you choose to ex- clude the 77000 you exclude 5274 of your gross income 77000 146000 and 5274 of your business expenses 90713 is attributable to that income and is not deducti- ble.

If the amount on line 2 is 100000 or more use the Tax Computation Worksheet 5. Dont use a second Foreign Earned Income Tax Worksheet to figure the tax on this line. Typing drawing or uploading one.

If the amount on line 2 is less than 100000 use the Tax Table to figure this tax. This does not apply tax directly on the FEI but the exclusion does bump the tax rate. Foreign Earned Income Tax Worksheet.

Complete the Child Tax Credit Worksheet later in this publication. Can I Claim the EIC. Subtract line 5 from line 4.

And foreign earned income. Scroll down and select Form 1040 Foreign Earned Income Tax - Foreign Earned Income Tax Worksheet. You will find 3 available alternatives.

To claim the EIC you must meet certain rules. Fortunately you can usually use a Foreign Tax Credit for any income that is not excluded by the FEIE. This tax worksheet calculates the exclusion of foreign earned income and foreign housing deduction.

Income allocated to foreign earned during the assignment is used to calculate the Form 2555 exclusion. Enter the amount from Form 1040 or 1040-SR line 11b. If you meet certain requirements you may qualify for the foreign earned income exclusion the foreign housing exclusion andor the foreign housing deductionTo claim these benefits you must have foreign earned income your tax home must be in a foreign country and you must be one of the following.

Tax on the amount on line 2. Foreign earned income tax worksheet 2014 question. Joined Feb 19 2015.

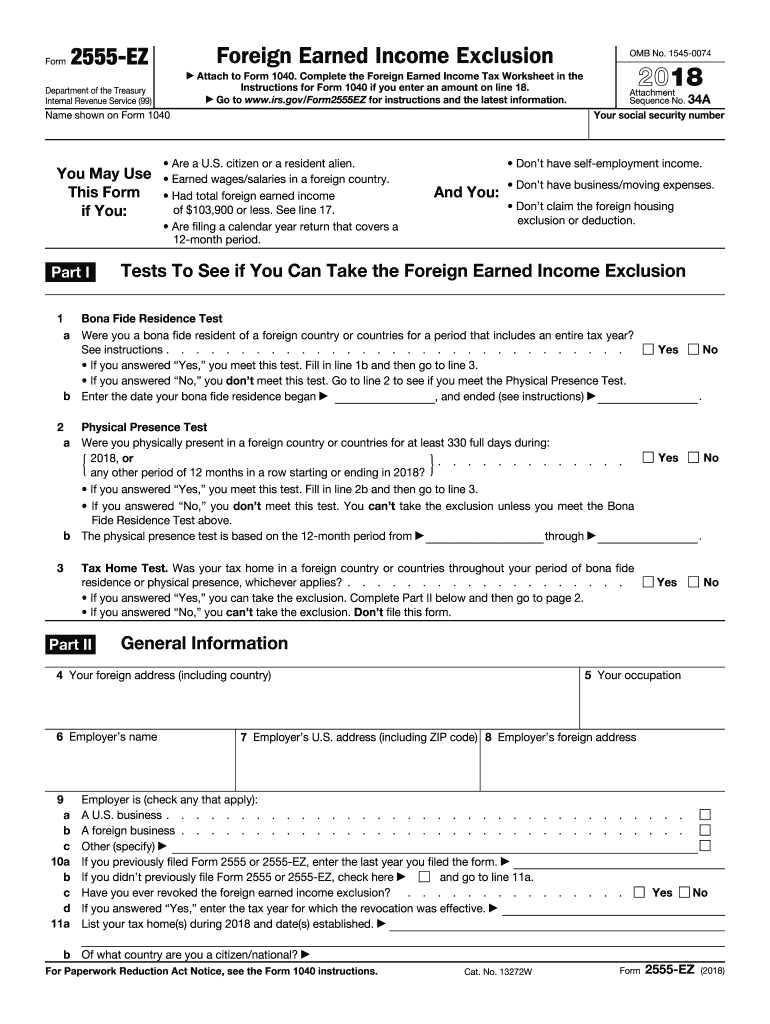

Show your total income and expenses on Schedule C Form 1040. If you are claiming more than 1000 you will first need to work out your foreign income tax offset limit to determine your entitlement. The 77000 is foreign earned income.

Ensure that the info you add to the Foreign Earned Income Tax Worksheet is updated and accurate. Foreign income earned before during and after the foreign assignment is reported less any applicable exclusion by Form 1116 as eligible for the foreign tax. The Foreign Earned Income Tax Worksheet figures the applicable tax rate by combining the amounts line 3 and subtracting from that tax calculation line 4 the tax that would have been due on the foreign earned income line 5.

See the instructions for line 11a to see which tax computation method applies. Since you are excluding 107600 of your 150000 gross receipts you will need to multiply that same ratio by the expenses that are directly related to your Schedule C gross receipts as follows. Fill out each fillable area.

The earned income credit EIC is a tax credit for certain people who work and have earned income under 52427. Expand the Federal folder then expand the Worksheets folder. This income will appear on Form 1040 Line 7 if entered in the Foreign Employers Compensation Amount field or Form 1040 Line 16 if entered in the Foreign Pension Received or Taxable Amount of Foreign Pension fields.

Jump to Latest Follow 1 - 8 of 8 Posts. Click the Forms button in the top left corner. Complete the 1040 and 1040NR Filers Earned Income Worksheet later in this publication.

Select the Sign tool and create an electronic signature. To enter foreign wages or foreign retirement income reported to a taxpayer by means other than a Form W-2 or Form 1099-R in the TaxACT program follow the appropriate steps below. It reduces the amount of tax you owe.

Add the date to the sample using the Date option. Citizen who is a bona fide resident of a foreign country or countries for an. These rules are summarized in Table 1.

The EIC may also give you a refund.

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

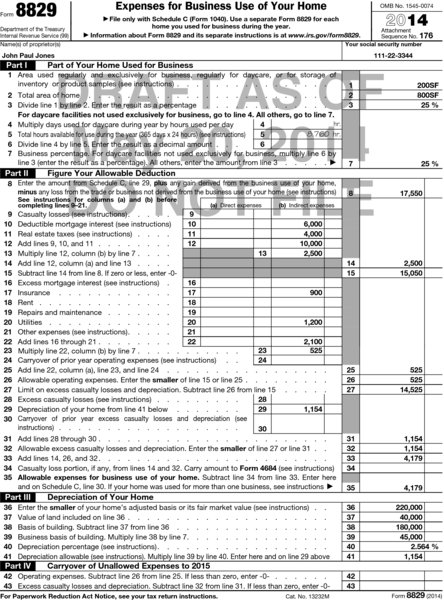

Fill Free Fillable Irs Pdf Forms

Self Employment Income How To File Schedule C

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Signature Change Application Fill Online Printable Fillable Blank Pdffiller

Foreign Earned Income Exclusion Form 2555 Verni Tax Law

Https Irstaxforumsonline Com Sites Default Files Players Calfe17 Downloads Calfe17slides Pdf

Timely Filing The Feie Form 2555 Expat Tax Professionals

Https Irstaxforumsonline Com Sites Default Files Players Calfe17 Downloads Calfe17slides Pdf

Wage Tax Statement Form W 2 What Is It Do You Need It

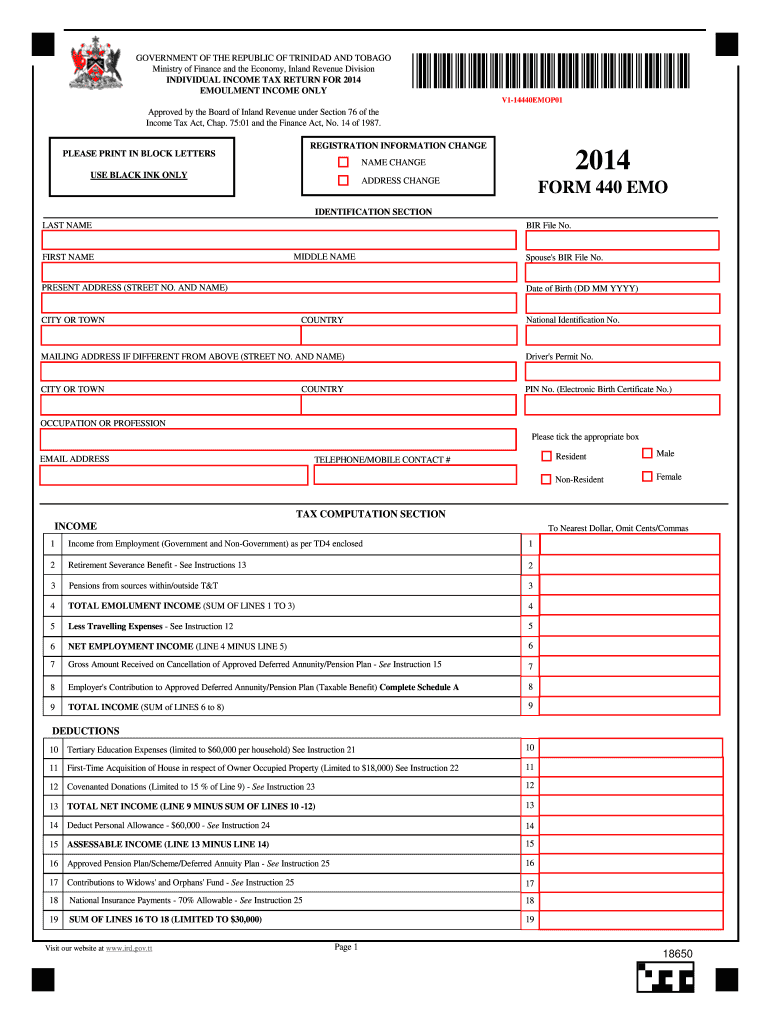

2014 2021 Tt Form 440 Emo Fill Online Printable Fillable Blank Pdffiller

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Tax Forms

0 comments:

Post a Comment